Jay and I joined bank accounts very early on in our relationship. Looking back now, I wouldn’t recommend it but from the start we said “my money is your money” and went on from there. This lead to many fights about spending habits, savings, etc, but it also lead to us growing together and finding what works for us. It’s still a learning process but we’ve now developed a way that meets all of our needs.

With my mom being an accountant, she had suggested I make a spreadsheet to keep track of our bills, how much we want to save, and how much we want to spend. After years of trial and error with this process, I finally sat down to create something that I could stick to.

Jay gets paid weekly and I get paid bi-weekly so we work with the combined Weekly & Bi-Weekly spreadsheet that organizes our finances based on that pay schedule. I put a download link at the bottom for that and I also created one for those of you that get paid weekly and those of you on a bi-weekly.

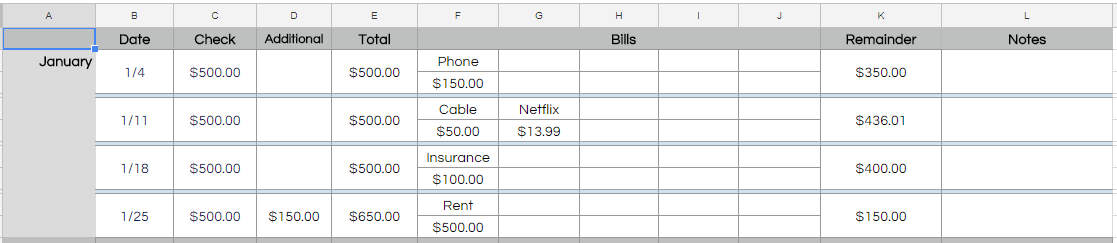

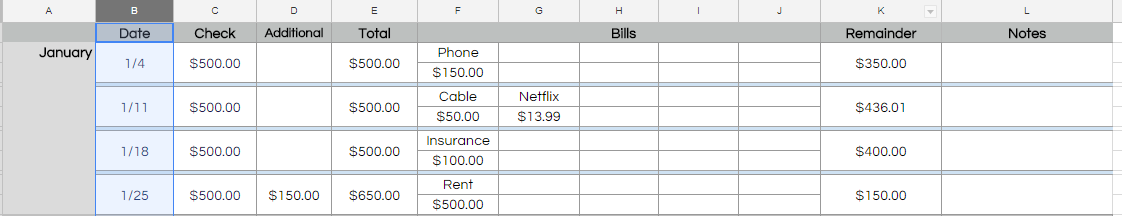

Weekly

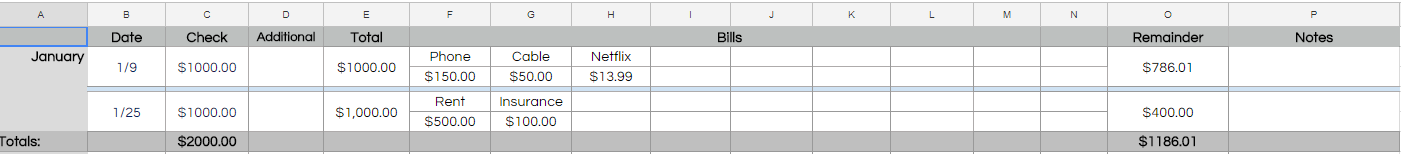

Bi-Weekly

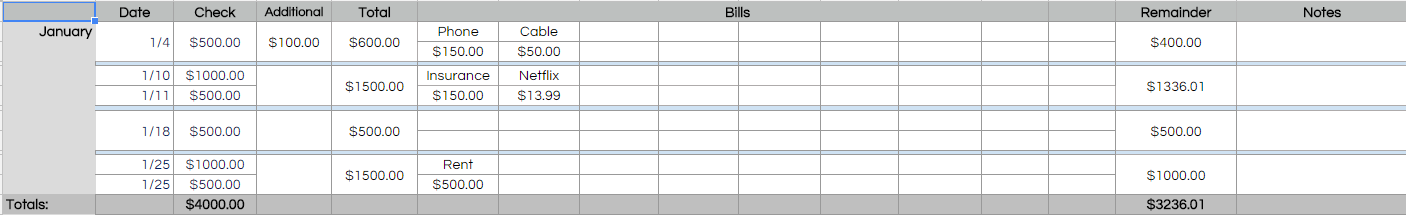

Weekly & Bi-Weekly

I assume most people get paid on a weekly schedule so I’ll use that to explain.

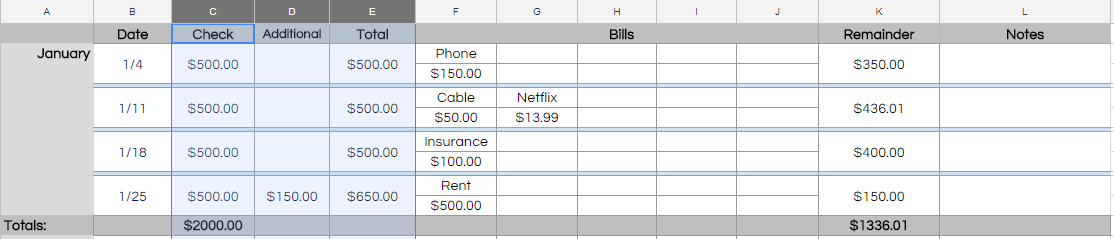

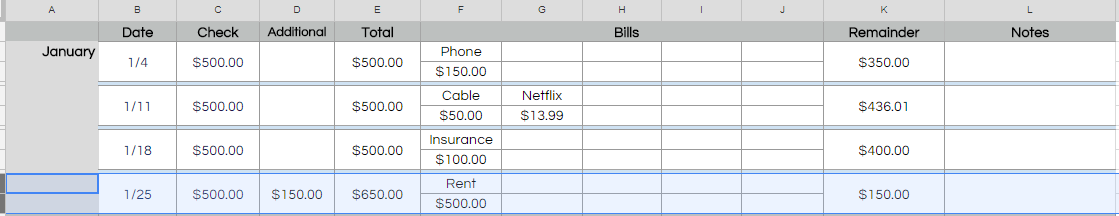

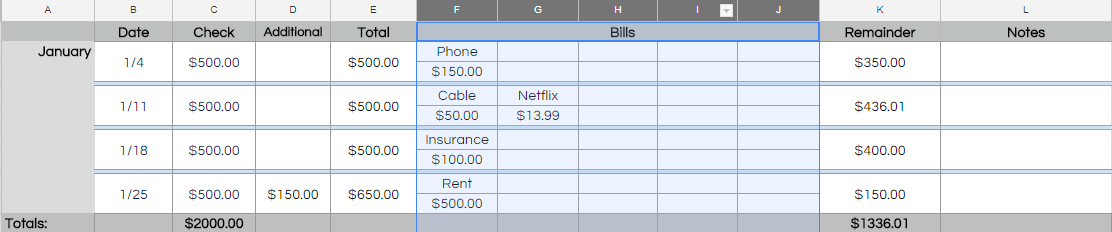

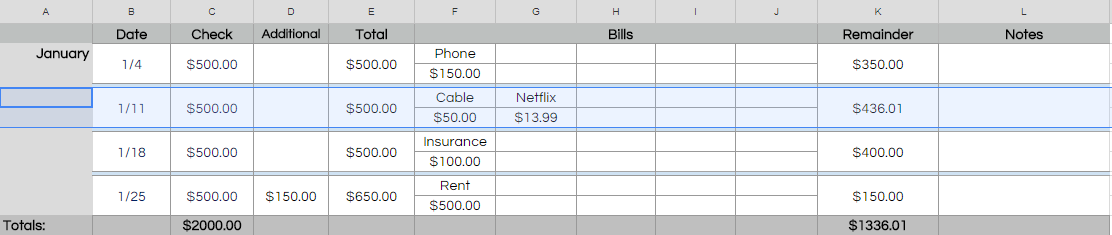

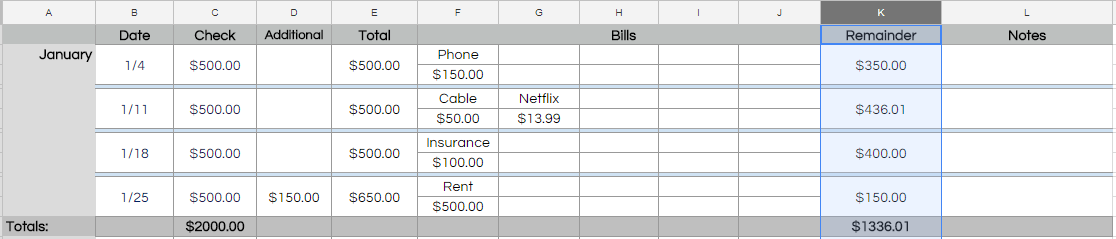

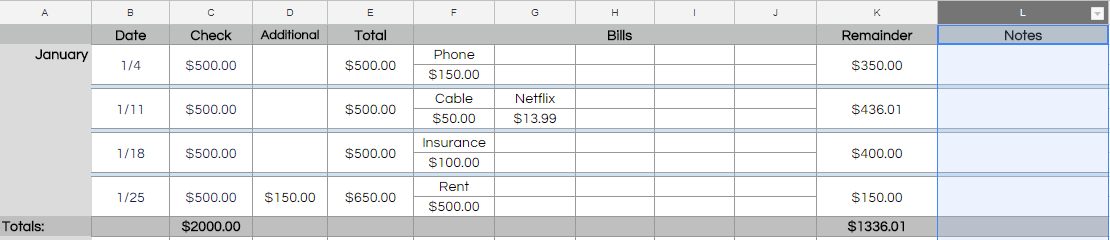

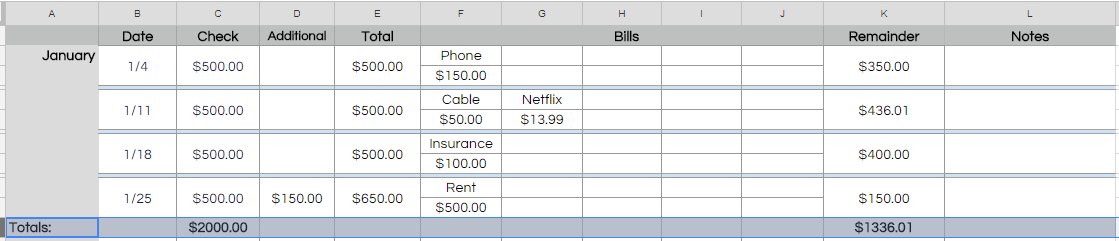

The spreadsheets are organized for 12 months as you’ll see in column A. For column B, you would put the date you get paid.

Column C is the amount of your paycheck. Column D is any additional funds you receive, whether it be a a bonus you receive, any money you win off a scratch ticket, your grandma handing you a ten dollar bill. Whatever extra money you get that’s not in your paycheck, you put in the additional column.

Column E is the total of what you got paid, plus anything you put into the additional column. It just allows for more accuracy.

For columns F – J, you add your current monthly bills as well as anything you need to pay in that round of checks. In the top row, you add the name, in the bottom you add the amount you pay.

This is one of the biggest organizing factors for me. I file the bills based on the check I’d pay them with.

For example, if Netflix is due on 1/14, I’d file it under the 1/11 check date.

Column K is what’s left after you account for bills. It will be the sum of Column E minus the amounts of columns F – J. The calculation looks like SUM(E2 – F3 – G3 – H3 – I3 – J3). If you add a new column or row, make sure you apply the correct box number otherwise you’ll receive an error.

For example: SUM(E2 – F3 – G3 – H3 – I3 – J3 – K3) Not K2 as K2 would be the “name” box and you’d get an error as it’s not recognized as part of the calculation.

The notes section is for any reminders. I usually put things such as “withdraw $X from savings.”

Another thing you might notice is the “Totals” row. This accounts how much you got in paychecks and what you’re left with after paying what needs to be paid.

Knowing this amount let’s us see what we can do without but also what we can work with to save for something like a vacation or a big purchase.

For us, using a spreadsheet helped us really see how much we were making and how much we were working with after paying bills. It was eye-opening to say the least.

DOWNLOAD LINKS:

Weekly – Weekly Budget Spreadsheet

Bi-Weekly – Bi-Weekly Budget Spreadsheet

Weekly & Bi-Weekly Combined – Weekly & Bi-Weekly Budget Spreadsheet

Let me know if this helps any of you or if you have any questions. I’m happy to help. 🙂